Bankers, Big Tech, and Sex Trafficking

On Tuesday, JPMorgan Chase Bank, N.A. (“Chase”) joined the list of Jeffrey Epstein’s beneficiaries who settled out-of-court, thereby avoiding the lurid details of their associations with child sex trafficking from coming to light during trial.

In another sex trafficking case last month, Salesforce lost at the 7th U.S. Circuit Court of Appeals in a case brought by a trafficked child and her mother whom allege that Salesforce helped build Backpage’s child sex trafficking customer base with its CRM software and consulting services. Backpage was heavily utilized by the child’s captor to sell her for sex.

Snuggling Up To A Sex Trafficker

It all began back in 2013, five years after Backpage was publicly identified by state attorneys general, federal officials, and law enforcement as being involved in sex trafficking, leading many companies to refuse to do business with Backpage. Salesforce, however, began providing services to Backpage at that time. For the next five years, as Backpage earned the great majority of its business from advertisers of prostitution, and grew to become the second-largest classified advertising Web site in the world, Salesforce worked closely with Backpage to customize its software for the Web site and develop many aspects of its sex trade business on Salesforce's Software As A Service (SaaS) platform. During the first two years alone of the Salesforce engagement, Backpage's revenues skyrocketed from $71 million to nearly $350 million as demand for sex with fresh, unaccompanied minors coming across America's southern border fueled the business model. So lucrative was the mutually beneficial relationship that it continued until 2018, which is when Backpage pleaded guilty to the felonies of operating the site for the sale of illegal sex, for receiving benefits from the sex trafficking of minors, and for money laundering.

In its defensive argument at the 7th Circuit, Salesforce primarily relied upon Section 230 of the Communications Decency Act to claim that it has immunity to prosecution. That section provides that

“[n]o provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.”

The appellate court ruled that Salesforce’s intimate, enabling relationship with Backpage from 2013 to 2018 bars it from being simply an arms-length provider of generic services. Because of that decision, which overturns the lower court’s ruling, Salesforce faces civil liabilities under 18 U.S.C. § 1595- the Trafficking Victim Protection Act (“TVPA”)- if the child and her mother prove that the company knew, or should have known, that Backpage was earning substantial profits from sex traffickers.

Chasing Child Sex Profits

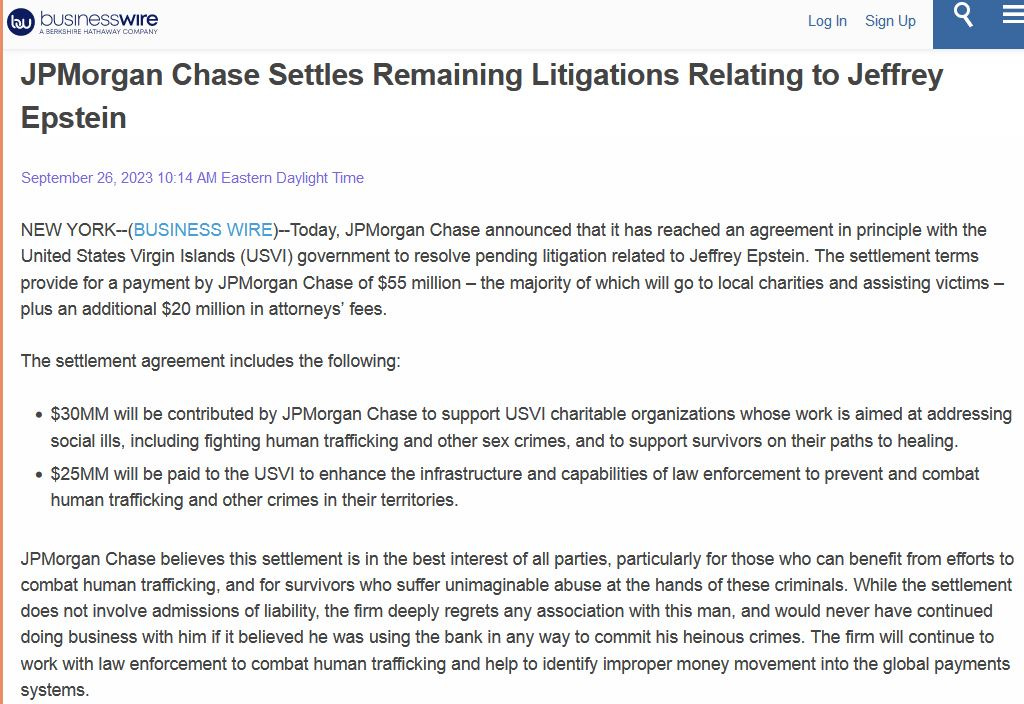

While the appellate ruling in the Salesforce case creates a labrys that could fell innocent third-party providers whose customers commit crimes, the $75 million settlement of the Chase case is more clearly appropriate, though hardly a significant consequence for the bank. In this case, the U.S. Virgin Islands sued the bank for $190 million for knowingly providing transactional services to Epstein’s child sex trafficking operation from 1998 to 2013.

The Virgin Islands filed its federal suit on the heals of one of the “Jane Doe” class action suits filed against Chase, alleging it aided and abetted the intentional infliction of emotional distress and negligence of Jane Doe and other trafficked minors by way of its executives’ close relationship with Epstein. James Edward Staley, who was the CEO of Chase’s Asset Management line of business from 2001 to 2009, and CEO of its Corporate and Investment Banking division from 2009 to 2013, and a board member of Institute of International Finance, was one of those executives. As the lawsuit asserts,

“Epstein agreed to bring many ultra-high wealth clients to JP Morgan, and in exchange, Staley would use his clout within JP Morgan to make Epstein untouchable….Staley helped accumulate other protectors of Epstein within JP Morgan (such as Mary Erdoes) who were also willing to turn a blind eye to Epstein’s blatantly illegal operation.”

Corrupt Legacy

JPMorgan Chase Bank, an American multinational investment bank and financial services company incorporated in Delaware and headquartered in New York City, is the largest bank in the United States. It obtained that status, in large part, buy using its money, power and influence, as well as operatives within and without government, to destroy and consume other financial institutions. While it shackles law abiding customers with the strictest “Know Your Customer” rules, tracking and flagging cash flows, limiting cash withdrawals to tiny sums, and reporting lawful transactions as suspected money laundering activity, these sex trafficking lawsuits revealed that the bank apparently doesn’t apply those same rules to its wealthy criminal clients. For example, this Doe case asserted that,

“In 2004, at the height of Epstein’s sex trafficking and abuse operation,

when he was transferring massive amounts of hush money to his victims and

recruiters and withdrawing hundreds of thousands of dollars in cash so that all the

payments were not traceable (the most obvious red flag for any criminal enterprise),…JP Morgan allowed Epstein to engage in structuring violations and other financial maneuvers required to maintain a criminal enterprise.”

Did you catch that? As restrictions upon access to your money continue to get tighter and tighter, this information may soon become useful. When your banker accuses you of structuring your tiny, lawful transactions, and puts your money on hold, and claims there's nothing he can do about it per federal regulations, you can now refer to the Doe v. Chase lawsuit and remind him that James Staley, a CEO at JPMorgan Chase Bank for 12 years, was able to activate levers in the system such that criminals with 100X your transaction amounts had no problems whatsoever for years. This proves that the system provides work-arounds, so your banker should be able to activate them for you.

Corrupt Practices

Now, going back to the investigation conducted by the United States Government,

“The investigation revealed that JP Morgan knowingly, negligently, and

unlawfully provided and pulled the levers through which recruiters and victims were paid and was indispensable to the operation and concealment of the Epstein trafficking enterprise….JP Morgan knowingly facilitated, sustained, and concealed the human trafficking network operated by Jeffrey Epstein from his home and base in the Virgin Islands, and financially benefited from this participation, directly or indirectly, by failing to comply with federal banking regulations. JP Morgan facilitated and concealed wire and cash transactions that raised suspicion of— and were in fact part of— a criminal enterprise whose currency was the sexual servitude of dozens of women and girls in and beyond the Virgin Islands. Human trafficking was the principal business of the accounts Epstein maintained at JP Morgan.”

As the government’s case unfolded, documents revealed that Staley and current Chase CEO Jamie Dimon, knew about Epstein’s sex trafficking operation as early as 2008. In fact, Chase turned around and sued Staley in March of this year for “indemnity, contribution, breach of fiduciary duty, and breach of the faithless servant doctrine.”

Documents in the case further revealed that Deutsche Bank AG also serviced Epstein’s sexploitation enterprise, and that the government served, or attempted to serve, subpoenas upon such notorious magnates as Larry Page to compel production of documents, including

“All Documents reflecting or regarding fees You paid to Epstein and/or JPMorgan in connection with Your accounts, transactions, or relationship at JPMorgan.”

“All Documents reflecting or regarding Epstein’s involvement in human trafficking and/or his procurement of girls or women for commercial sex.”

Expansive Enterprise

The proverbial Rabbit Hole is endless. The more we investigate the trails of evidence, the more overwhelmed we are by the extent of the billionaires’ global sex slave business, aided by open border policies such as those of the Obama-Biden regime1, which require border patrol agents to stand down, enabling millions of innocent children from poor countries to be funneled into the arms of brokers in “dream” countries such as the United States.

Who’s Next?

Last month, Chase agreed to pay $290 million to settle a lawsuit by dozens of Epstein's accusers, far surpassing the $75 million settlement paid to the Virgin Islands. Of that $75 million, $25 million is intended to be spent on enhancing the Virgin Island’s law enforcement infrastructure, specifically relating to human trafficking, $20 million will pay attorney’s fees, and the remaining $30 million will go to “charitable organizations focused on fighting human trafficking, sex crimes and other social ills as well as supporting survivors”. Given the deep roots of the billionaire-funded sex trade, and this tiny slap-on-the-hand that has been by Chase as a penalty, we seriously question whether the “charitable organizations” will be legitimate. Will they be helping to stop this vile industry, or will they be, in fact, front organizations- such as ACORN- actually enabling the recruitment and grooming of minors for the sex trade? If citizens around the world stop using Google’s services and demand that it stop covering-up news and facts of secret sex trafficking rings, we could see thousands more lawsuits against more billionaires and the companies they lead. We hope this happens.

Billionaire Salesforce founder Marc Benioff has contributed heavily to the Democrat Party and was named Co-Chairman for Obama Campaign.

JPMorgan Chase CEO Jamie Dimon has a long history of large contributions to democrats.