Video: The Hammer Falls on New Years Day

Laundering More Of Your Money In Support Of Terrorism

The hammer falls on New Year's Day, 2024. The Corporate Transparency Act of 2021 goes into effect. While the name would lead you to believe that this new law will finally allow you to see the dirty dealings between, for example, the FBI and the corporate executives at Facebook, Twitter and Google, it actually makes you the suspect under scrutiny.

The Ruse Continues

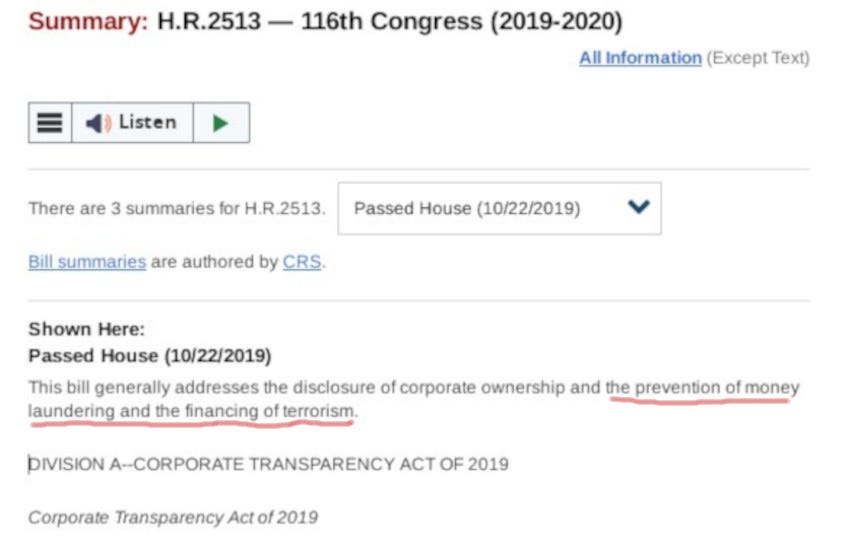

Introduced in 2017 under President Trump, incorporated into the National Defense Authorization Act, and passed into law in 2021, the stated purpose of the act was to protect you by preventing "money laundering and the financing of terrorism".

Hmm, we've been sold this bill of goods before, haven't we? Just to mention a few of the anti-money laundering laws already on the books, we have:

Bank Secrecy Act of 1970

Money Laundering Control Act of 1986

Anti-Drug Abuse Act of 1988

Annunzio-Wylie Anti-Money Laundering Act of 1992

Money Laundering Suppression Act 1994

Money Laundering and Financial Crimes Strategy Act of 1998

USA PATRIOT Act of 2001 (Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act)

Intelligence Reform & Terrorism Prevention Act of 2004

And to stop terrorism, we have:

Public Health Security and Bioterrorism Preparedness and Response Act of 2002

Homeland Security Appropriations Act of 2007

After All, It’s Your Fault

Now if you've been awake for just a little while, you're aware that more of your liberties were confiscated every time one of these laws was set into motion. The Corporate Transparency Act is no different.

Effective January 1st, small statutory entities, such as Corporations, LLC's, and even some Sole Proprietorships that are used by Mom-and-Pop businesses and families are, required to report private information on their "beneficial owners". A beneficial owner is defined as an individual who, directly or indirectly, whether by contract, arrangement, understanding, relationship or otherwise,

Exercises substantial control over an entity, or

Owns or controls at least 25% of the entity's ownership interest.

Endless Appetite

The initial information grab includes the names, dates of birth, residential addresses, business addresses, and government I.D.'s of such people having control or ownership interest in a corporation, LLC, or other statutory entity. As we've seen under the Patriot Act, the Dodd–Frank Wall Street Reform and Consumer Protection Act, and many others, the Corporate Transparency Act is expected to require the disclosure of more and more information over time.

Trust Us. We’ve Earned It.

This private data will be stored in a database managed by the Financial Crimes Enforcement Network (FinCEN), which is part of the Treasury Department. Who has access to this private information? The usual thieves, including the IRS, banks and financial institutions, and even foreign policing agencies. Most unsettling is the fact that the Treasury Department has broad authorization for the way it uses the information.

The Act also includes a provision prohibiting the issuance of any type of bearer certificate evidencing ownership in the entity, as well as heavy civil and criminal punishments for violations of the obligations of the CTA. The civil penalties can be $500 per day for non-compliance, and the criminal fines can be $10,000 and/or imprisonment for up to two years. Oh, and did I mention banks are excluded from reporting under the CTA?

Your Loss, Their Gain

So what does this mean for you? Unless you are part of the Biden crime family, which has escaped having to disclose the players behind the hundreds of shell companies used to launder more than $20 million from America's enemies, you will now be forced to disclose previously confidential information about your small business or family inheritance organization. Through the use of A.I., that information will enable rogue agents in corrupt federal agencies to go on hunting expeditions into the operations of your non-Woke business.

Use Their Tools

Thankfully, we have a solution.

Statutory companies formed after 2024 have to report this private information beginning January 1st. However, companies already in existence have until January 1st, 2025. So if you you already have one of these vulnerable entities, it's time to begin transitioning to a structure that doesn't fall under government regulations.

For centuries, the global elites have escaped every draconian law that has been designed to rob property and privacy from the common man. This is due to the fact that they craft the laws so that they do not apply to the entities through which the elites conduct their affairs. Such entities are structured to avoid federal regulations. We know this because, in the '90's, Passage To Liberty was able to procure the forming documents of such an entity. Since then, we've witnessed its power to protect assets and privacy, even while high-powered law firms continue to deny that such a thing exists.

Freedom and privacy are priceless. If you've had enough government interference in your life, contact Passage To Liberty to find out more.