Beware Prepaid Card Piracy

Millions of Americans who have had their rights violated over the past half-century, and overtly violated during the past five years, have been seeking ways to live anonymously and peacefully in a world that’s lost it’s mind and morals. Many who have been censored, shadow banned, lost their jobs, jailed, and even physically assaulted for simply expressing logical, science-based reasons for not believing that humans can change global climates, that men can become women, that government schools should have more authority than parents over their children, that children should be indoctrinated with racism, that bureaucrats should have the final authority over personal health, financial, and education decisions, and that experimental injections should be mandated while proven, long-prescribed medications are prohibited, have been seeking means to conduct their lawful transactions privately. One of the ways people are attempting to avoid the attacks is by getting away from platforms that track, store, analyze and catalog user activities. The prepaid debit card has traditionally been a tool to keep spies from tracking how money is spent. However these cards can no longer be trusted.

The Inducement

The scheme begins when a patron browses the rack of prepaid debit cards baring Visa and Mastercard logos near the register in a large chain store, such as Target, CVS, Walgreens or Walmart. For illustration purposes, we'll name that person "Liberty". Liberty then pays, for example, 100 Federal Reserve Notes (“FRNs” or “cash”), plus a $5.95 activation fee, to the cashier to load 100 FRN's onto the card, whereupon the cashier informs him that all sales are final; the card cannot be returned for refund. This should be his first clue that something is awry.

The Clues

As he is leaving the store, Liberty wonders how the card issuer making money when he paid only a $5.95 surcharge to buy the card. After all, $5.95 is collected by the store to display and sell the card, leaving apparently nothing to cover the costs of the issuer to license the Visa and Mastercard logos, print and distribute the cards, and manage them. Setting this question aside for the moment, Liberty opens the package and sees, on the back of the card, that the card is issued by Sutton Bank and distributed by InComm Financial Services (1-833-322-6760 or P.O. Box 826, Fortson, GA 31808). The instructions there tell him to activate the card by calling 833-563-8200 or to go to securespend.com. But wait, he had already paid $5.95 to the cashier, who told him that the card was now activated. Disturbed by the inconsistency, he proceeds to open the package further. He then encounters a two-page, microprint agreement between him and Metabank, NA(Pathward)1 for his SecureSpend Prepaid Visa Card.

The Hook

Upon reading the contract, he learns that his spends will neither be secure nor private, but that’s the just the beginning of the bad news. The ominous agreement states that his acceptance and use of the card constitutes his acceptance of the terms. It informs him that a Personal Identification Number ("PIN") would be created by him during his first transaction, which he later finds to be a difficult process in itself. The agreement also contains a PRIVACY clause informing Liberty that the information that would be obtained on him from his purchases and otherwise was anything but private. Following that paragraph is a JURY TRIAL WAIVER AND ARBITRATION clause, which says that he agrees to waive his right to a jury trial in the event of a dispute, and that he also agrees to an arbitration process (with its panel determined by InComm/Pathward) that strips him of his right to bring any court action and bars his ability to achieve a fair settlement:

“Any claim, dispute, or controversy (“Claim”) arising our of or relating in any way to: (i) this Agreement; (ii) the Card/Virtual Account; (iii) your acquisition of the Card/Virtual Account; (iv) your use of the Card/Virtual Account; (v) the amount of available funds in the Card/Virtual Account; (vi) advertisements, promotions or oral or writtten statements related to the Card/Virtual Account, as well as goods or services purchased with the Card/Virtual Account; (vii) the benfits and services related to the Card/Virtual Account; or (viii) transactions on the Card/Virtual Account, no matter how described, pleaded or styled, shall be FINALLY and EXCLUSIVELY resolved by binding individual arbitration conducted by the American Arbitration Association (“AAA”) under its Consumer Arbitration Rules. This arbitration agreement is made pursuant to a transaction involving interstate commerce, and shall be governed by the Federal Arbitration Act (9 U.S.C. 1-16). We will pay the initial filing fee to commence arbitration and any arbitration hearing that you attend shall take place in the federal judicial disctrict of your residence.

ARBITRATION OF YOUR CLAIM IS MANDATORY AND BINDING. NEITHER PARTY WILL HAVE THE RIGHT TO LITIGATE THAT CLAIM THROUGH A COURT. IN ARBITRATION, NIETHER PARTY WILL HAVE THE RIGHT TO A JURY TRIAL OR TO ENGAGE IN DISCOVERY, EXCEPT AS PROVIDED FOR IN THE AAA CODE OF PROCEDURE. For a copy of the procedures, to file a Claim, or for other information about this organization, contact it at AAA, 335 Madison Avenue, New York, NY 10017, or at www.adr.org. All determinations as to the scope, interpretation, enforceability and validity of this Agreement shall be made finally and exclusively by the arbitrator, which award shall be binding and final. Judgment on the arbitration award may be entered in any court having jurisdiction. NO CLASS ACTION, OR OTHER REPRESENTATIVE ACTION OR PRIVATE ATTORNEY GENERAL ACTION OR JOINDER OR CONSOLIDATION OF ANY CLAIM WITH A CLAIM OF ANOTHER PERSON OR CLASS OF CLAIMANTS SHALL BE ALLOWABLE. This arbitration provision shall survive: (i) the termination of the Agreemnt; (ii) the bankruptcy of any party; (iii) any transfer, sale or assignment of the Card/Virtual Account, or any amounts owed on the Card/Virtual Account, to any other person or entity; or (iv) expiration of the Card/Virtual Account. If any portion of this arbitration provision is deemed invalid or unenforceable, the remaining portions shall remain in force. IF YOU DO NOT AGREE TO THE TERMS OF THIS ARBITRATION AGREEMENT, DO NOT ACTIVATE OR USE THE CARD/VIRTUAL ACCOUNT. SAVE YOUR RECEIPT AND CALL 1-833-322-6760 TO CANCEL THE CARD/VIRTUAL ACCOUNT AND TO REQUEST A REFUND.”

At this point, Liberty should suspect that he’s been scammed. For, at the very least, he will have to provide some a name and address when he calls to request a refund, which exposes him as a likely privacy advocate.

The Con

Liberty then proceeds to use the card to pay a bill, whereupon his transaction gets rejected. So he punches-up www.securespend.com to see if he can determine the source of the problem. Upon entering the card data and other personal information into the Web site, Liberty gets prompted to create a 4-digit PIN. Upon entering the digits and submitting the form, the site tells him that the card has been activated. Liberty then tries again to use the card. Once more, the transaction gets rejected. At this point he calls the number on the back of the card and, after waiting on Hold for about an hour, he gets told by the call handler in the Philippines that the card has been de-activated and cannot be re-activated. Over the next hours, if he has the patience, Liberty will be told in robotic fashion that the only solution is to send him a replacement card. To do that, they must have his name and address. So, to have any hope of not losing his $100, he provides his phone number, name (or pseudonym) and address, creating more links to his true identity.

The Steal

The people at InComm/Pathward’s call center assure Liberty that the card will arrive within two weeks. However, he will learn that the card will never arrive. Having never read an article like this one, he will spend many additional hours over the coming months on the phone with the call center reps, who will tell him that the card was delivered by Fedex. However they will "not be able to supply a tracking number." Nevertheless, they all “guarantee” that the card will arrive within one or two weeks. When pressed to provide a mechanism to back-up that guarantee- such as a written agreement- the reps repeat a scripted answer: Delivery is guaranteed and no tracking number of proof-of-delivery can be provided. To multiply the frustration, they also say that the card would have to be activated by Liberty calling and providing additional personal information, which should finally warn him of one of the apparent purposes of the scam: To expose, gather, analyze and sell information on people who want to keep their personal information private.

The Upshot

Although he receives many guarantees, Liberty never receives a replacement card. So, after researching and gathering data from various forums, court records, and message boards, he discover sthat the scheme involves multiple players and fictitious business names, and that the players are involved in lawsuit after lawsuit, including those brought by state governments, and class actions such as this one for breach of personal data. The players include Pathward, N.A., InComm Financial Services, Inc., InComm Payments, and Blackhawk Network, Inc., DBA Blackhawk Engagement Solutions. Upon deeper digging, Liberty learns that the defendants typically settle out of court after the defense attorneys have milked the defendants for a year because, according to long-standing decisions like Buckeye Check Cashing, Inc. v. Cardegna, 546 U.S. 440 (2006), arbitration clauses are enforced even if the contracts underlying them are clearly fraudulent. In other words, if a person agrees, even tacitly, to an agreement containing an arbitration clause, the courts will send the case to arbitration, where the arbitrators- nearly always appointed by the contract issuer- will decide if fraud occurred.

The Quasi-Solution

Whether intended for personal use or as gifts, stay away from pre-paid debit cards. However, if you must buy a card, buy a Vanilla card from Walgreens and save a digital scan of your receipt (the receipts fade very quickly). Walgreens has a fraud department (877.865.9130, option 3) that will issue a case number and refer you to Vanilla (800.571.1376, opton 3) for replacement. If the contract contains a provision to opt-out of the arbitration clause, make sure to immediately do that before using the card by sending copies, with proof of delivery, of your notice and receipt to:

Pathward, N.A., 5480 Corporate Dr. #350, Troy, MI 48098

and

InComm, 250 Williams Street NW, Atlanta, GA 30303.

If you get scammed and need to take legal action, we are here to help. PTL can prepare the federal complaint and other necessary documents, and provide guidance for your pro per civil action. We want to help stop such scams, as well as help victims receive just compensation. Just email to help@passagetoliberty.com. Keep in mind that, if you didn’t exercise the option to opt out of the arbitration clause, you’d be stuck having to settle out of court, which is typically for an amount that could be only 5x or more of your card spend. However, the settlement agreements forbid plaintiffs from warning others about the scam. In fact, even saying anything negative about the scam, scammers, lawsuit, etc. in any fashion via any means is prohibited, as is suing the defendants for any damages in the future.

Passage To Liberty provides defensive training and assistance to people seeking to retain their rights and liberties in a constitutional republic. Arm yourself at PassageToLiberty.com.

1Metabank changed its name to Pathward in 2022 after selling the name to Meta Platforms for $60 million

The Best Solution

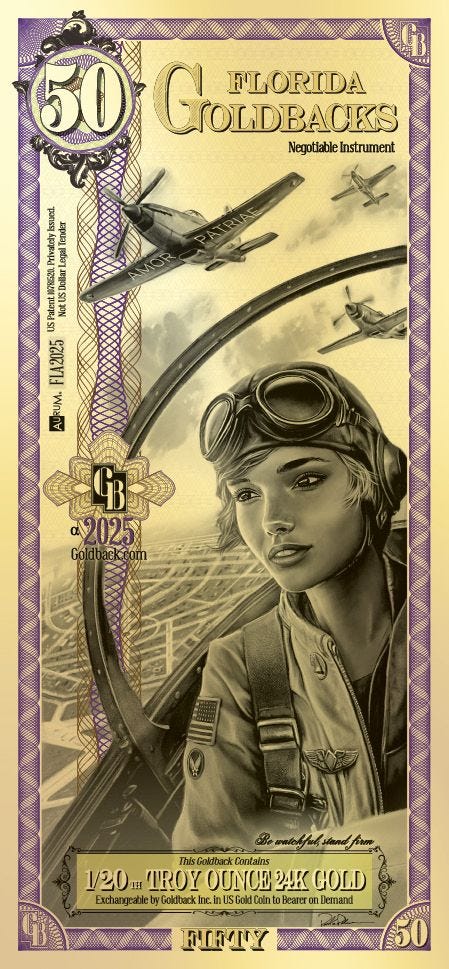

You can now use Goldbacks to preserve your privacy. More and more merchants across America are accepting Goldbacks instead of credit cards, debit cards and cash, for they contain real 24k gold, anti-counterfeiting technology, serial numbers, patent numbers, and incredible artwork. The are not only rapidly gaining attention as the best alternative to Federal Reserve Notes, but as unique works of art that have intrinsic value beyond the beauty.

If you’d like to support the work we do at Passage To Liberty and preserve your privacy, please click here to get yours today.