It's not often that a major bank, whose existence depends upon buying and selling various forms and derivatives of fiat currency, issues a report exposing the frailty of its main product, Federal Reserve Notes. However, according to the Wallstreet Journal, Citi Research analysts did just that. Global instability, such as the escalating Israel+Hamas+Iran war and the Nato dogpile upon Russia, combined with record high central bank purchases (more than 1,000 tons of gold in each of the past two years), the increasing global plandemic-born recession, the de-coupling of the U.S. dollar, and oil prices beginning to climb for summer are some of the factors driving gold's steep trajectory. According to Aakash Doshi, Citi's North American head of commodities research, one of the biggest factors driving the consumption surge is the ferocious rate at which central banks are buying-up all the gold. If the pattern continues, and there aren't major reversals in the other factors, he predicts gold to hit $3,000/oz. within the next twelve to eighteen months. That's a 27% increase from the today's price, which is already up over 14% since January of this year.

State-Sponsored Gold Rush

Doshi said that the global jewelry market accounts for approximately 50% of global gold demand. Thus, if central banks continue buying-up gold to the point where they have doubled their gold purchases, they will rival the gold demand of jewelers, forcing jewelry prices even higher. Yet also intensifying the demand are state governments. Seeking safety in a currency with intrinsic value, and wanting autonomy from Federal Reserve Notes and Central Bank Digital Currencies, more and more states are moving to enact legislation codifying gold as currency, Goldbacks in particular.

Sound Money Legislation Passed!

So far, Nevada, New Hampshire, South Dakota, Utah and Wyoming have passed legislation declaring that the Goldback, and gold in general, can be used as a medium of exchange (MOE), removing it from the taxable product category when the parties to the transaction use it as money. This shift in state monetary policy is catching-on in other states as well, along with the move toward other sound money policies, such as holding state reserves or pension funds in gold bullion, enforcing gold clause contracts, or intervening in the harassment of precious metals dealers and investors. As expected, this return to legitimate money is beginning to cause panic among the Federal Reserve's shareholders, leading some to speculate that they may, again, move to criminalize private ownership of gold.

States With Sound Money Policies

States that reaffirm gold as money and implement sound monetary policies enjoy the highest rankings on the Sound Money Index. To arrive at the index, each of the fifty states of the union is awarded points for each pro-sound money policy it enacts, with 40% off the possible points connected with sales and income taxes on the monetary metals. The remaining points are awarded for other sound money policies, such as those mentioned above. We've listed the top ten states below.

Wyoming

South Dakota

Alaska'

New Hampshire

Arkansas

Texas

Utah

Arizona

Nevada

Florida

States Pursuing Constitutional Money

To no surprise, there is a strong correlation between the list above and the list of states that already have, or are awaiting the design and minting of, their own official Goldback series. The states expected to roll out Goldbacks, more or less in this order, are:

Alaska

Arkansas

Texas

Arizona

Florida

Tennessee

Idaho

Oklahoma

Goldbacks Compared To Coins and Bars

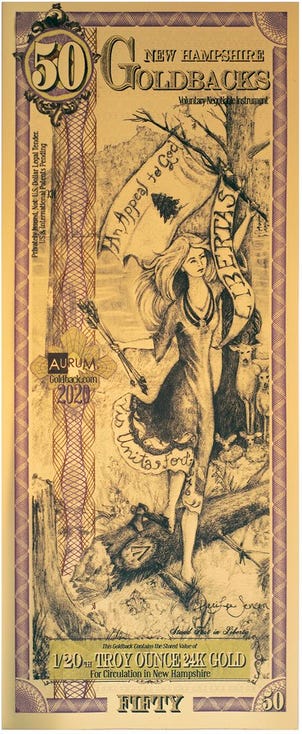

Unlike fiat currencies, such as central bank paper and digital currencies, Goldbacks actually contain 24k gold. But unlike gold and silver coins and bars, Goldbacks are specifically designed in small, spendable denominations. Furthermore, the technology, serial numbers and patents that go into every Goldback make it impossible to counterfeit. This cannot be said of gold and silver coins and bars, as many have recently discovered. These features, as well as anonymity, fungibility, and portability, have positioned the Goldback to uniquely fill the need for sound money.

To learn more about them, and to acquire Goldbacks, go to here.

Passage To Liberty Needs Your Support

In order to be able to spend the many hours of research needed to provide our subscribers with irrefutable evidence that goes into our reports, we need financial support. There are several ways our readers can do this:

Become a Paid Subscriber to this Substack.

Acquire Goldbacks from Passage To Liberty.

Attend a live training course in your area, such as the Rights Preservation course this Saturday.

Please consider generously supporting our work for truth and liberty.

We invite you to forward this article far and wide, watch and listen to our webcasts on Rumble, and visit Passage To Liberty’s Web site for the tools you need to live free.